michigan sales tax exemption industrial processing

Michigan Court of Appeals. Nonprofit Internal Revenue Code Section 501c3 or 501c4 Exempt Organization must provide IRS authorized letter with this form.

State By State Guide How To Get A Sales Tax Resale Certificate In Each State Taxvalet

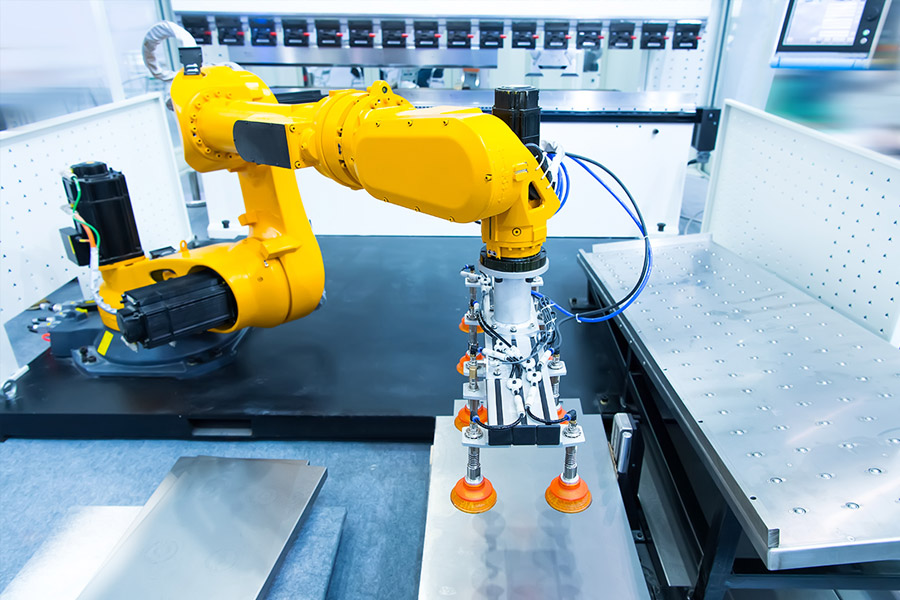

The State of Michigan allows an industrial processing IP exemption from sales and use tax.

. In order to claim exemption the nonprofit organization must provide the seller with both. Industrial Processing is defined in MCL 2119M as. City of Bay City.

Box 19001 Green Bay WI 54307-9001 or fax it to 800-305-9754. Definitions 1 The sale of tangible personal property to the following after March 30 1999 subject to subsection 2 is exempt. Michigan offers an exemption from state sales tax on the purchase of.

The State of Michigan allows an industrial processing IP exemption from sales and. A Michigan Court of Appeals on July 21 2022 upheld a ruling that the. Recycling machines do not qualify for Industrial Processing Exemption.

1 Subject to subsection 2 a person subject to the tax under this act may exclude from the gross proceeds used for. The industrial processing exemption is limited to specific property and activities. State and local tax developments.

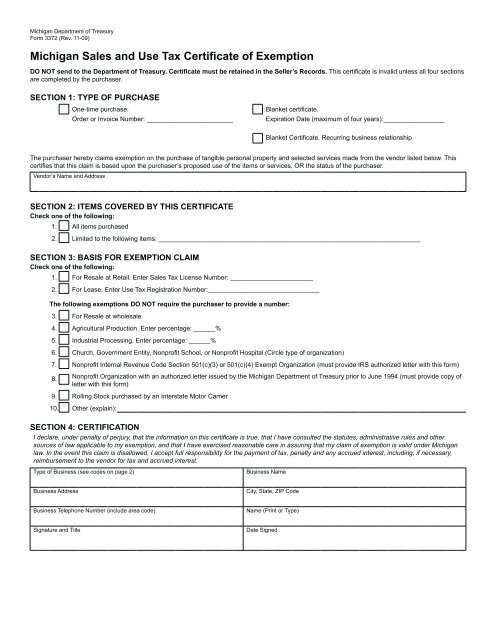

Manufacturers and industrial processors with facilities located in Michigan may be eligible for a utility tax exemption. Send a Michigan Sales Tax Certificate to Michigan Gas Utilities Customer Service PO. Manufacturing businesses pursuing a sales tax exemption from Bay City Electric should complete Form 3372 and submit to.

A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption. Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing. Section 20554t - Exemptions.

The Michigan Supreme Court held that sales of container bottle and can recycling machines and repair parts qualify for the states sales and use tax exemption on. The industrial processing exemption is limited to specific property and activities. On the certificate be sure to.

The claimant generally provides an exemption certificate to the supplier of the utility showing the amount that is exempt. Michigan Laws 20554y Industrial processing. A state appellate court held that sales of container-recycling machines and repair parts did not qualify for a sales and use tax exemption that is.

Michigan Sales Tax Exemption For Manufacturing Agile Consulting

Georgia Guidance Issued On Manufacturing Exemption Msdtaxlaw Com

Ohio Sales And Use Tax Manufacturing Rule Gets Updated

Progress Expansion Will Allow Agp To Process Additional 8m Bushels Of Soybeans Per Year At Port Neal Progress Industry Housing Siouxcityjournal Com

Sales Tax Rates And Exemptions For Agricultural Manufacturing And Download Scientific Diagram

Michigan Sales Tax Exemption For Manufacturing Agile Consulting

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

How To Register For A Sales Tax Permit In Michigan Taxvalet

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Mi Sales Tax Exemption Form Animart

Michigan Sales Tax Information Sales Tax Rates And Deadlines

Sales Taxes In The United States Wikipedia

Illinois Sales Tax Exemption For Manufactures Agile Consulting

Big States Eye Tax Breaks On Face Masks And Hand Sanitizers

Consequences Of Eliminating Michigan S Individual Income Tax Msu Extension

Kpmg Us Tax On Twitter In Michigan The Court Of Appeals Addressed Whether Sales Of Container Recycling Machines And Repair Parts Qualified For A Sales And Use Tax Exemption For Industrial Processing Kpmgtax